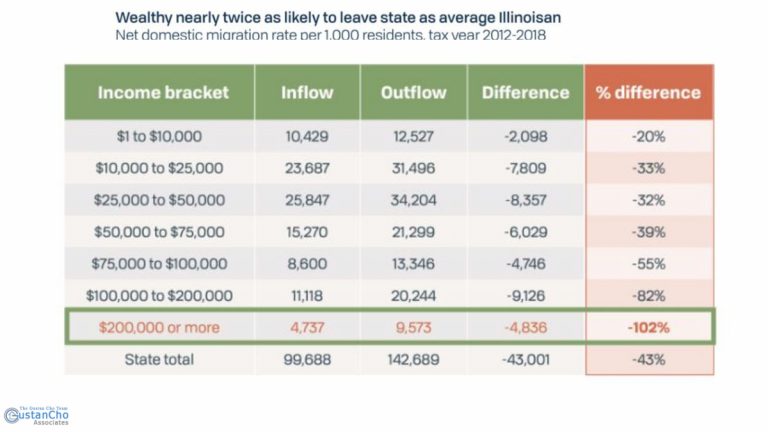

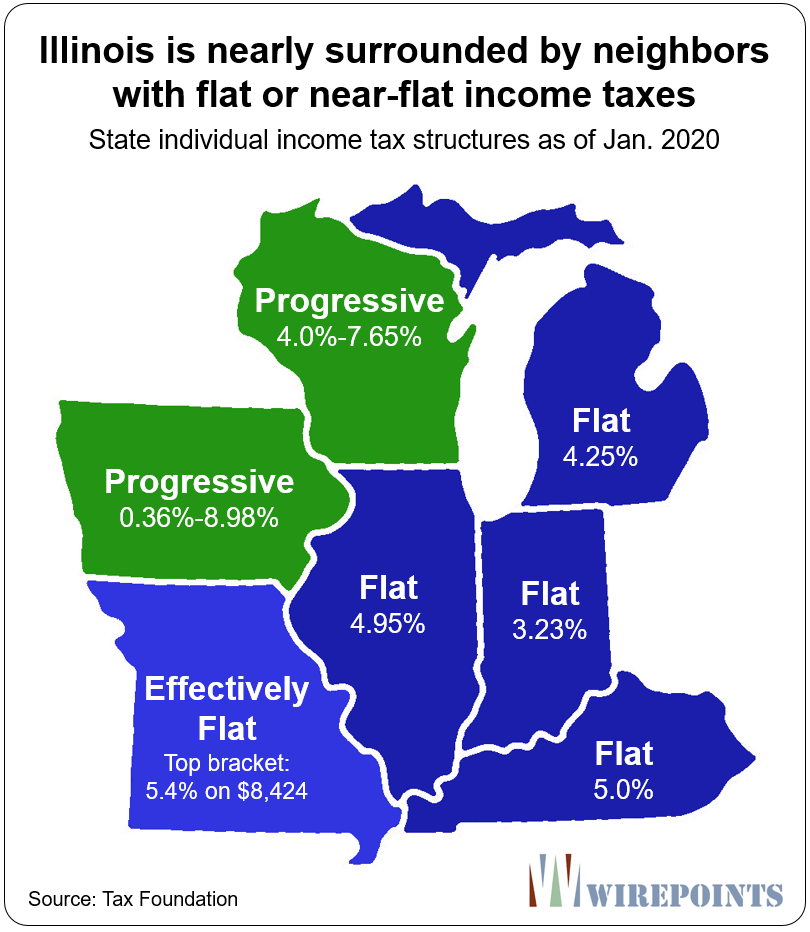

In a set of tweets this afternoon, Pritzker claimed that the only remaining options are to “immediately make billions of dollars in cuts” or “impose a higher flat tax, which falls disproportionately on working and middle-class families.” He then blamed “the millionaires and billionaires” for opposing it and accused them of “deceiving the public about its purpose.” What is Illinois’ path forward? Does it even have a path to fill the budget hole it was hoping to fill with the next tax rates? With 98% of the vote counted, the Chicago Tribune this morning reported that “no” votes exceeded “yes” votes by a margin of 55% to 45%. The outcome was stunning: despite months of ads telling voters that a “yes” vote would ensure that the wealthiest 3% of Illinoisans would “pay their fair share” and the rest of the state would see a tax cut, voters rejected the ‘Fair Tax’ amendment to the state’s constitution, which would have stricken from the constitution the requirement that the state’s income tax be levied as a flat percentage of income across all income levels. (AP Photo/Charles Rex Arbogast) ASSOCIATED PRESS

Pritzker the first major defeat of his 22-month tenure. Voters have rejected the Fair Tax proposal to abolish Illinois' flat-rate income tax for one that would take a greater share from wealthier taxpayers. A woman walks past a pro Fair Tax yard sign near a polling place on Election Day, Tuesday, Nov.

0 kommentar(er)

0 kommentar(er)